Today has been another stressful day for the Spanish risk premium. This has become a very common expression in the news since the economic crisis started. The media are constantly informing about the evolution of the Spanish risk premium and they say this evolution will be decisive for the economic future of the country. But what is the risk premium? What has been its evolution since the beginning of the crisis? How does it affect to our ordinary life? Let´s explain all these concepts in a simple way:

WHAT IS THE RISK PREMIUM?

The States need money to finance their projects and general expenses (public works, the Social Security, education, the administration). In order to get the money they need, the States collect taxes (direct and indirect taxes), but if the money they collect itsn´t enough, they issue bonds, treasury bills and debentures and sell them in the sovereign debt markets. These are the products the Spanish Treasury sells:

As the States sell their bonds in markets, their price will depend on supply and demand. In critical times, such as the present moment, investors look for safety and they tend to buy the bonds of the countries they consider safer in the long term. Safety is related to the economic situation of the countries (unemployment rates, Gross Domestic Product, health of the financial system, sovereign debt...). In the Eurozone (the area which comprises the countries that have the Euro as official currency) Germany is considered to be the safest country to invest money. Economists have invented a rate to define the risk for the investors who buy public bonds of a country of not getting their money back. This rate is established in relationship with the 10 year German bonds and it´s called risk premium and it´s measured in basis points (integer number and two decimals).

Let´s see an example:

If I buy a 10 year German bond today, the German government will have to pay me a yearly interest rate of 1.32 %. If the bond costs 100 €, this means that the German government will have to pay me 1.32 € per year and they will have to give my 100 € back in ten years. So in ten years my investment of 100 € will produce 13.2 €. This is not much money, but it´s a safe investment, because I trust in the German government ability of giving my money back in ten years. As there is a huge demand of German bonds, the German government can pay low interests. There have been days in which they sold bonds without paying any interest rate. For example, if the German bond costed 100 €, they didn´t offer any interest rate and they promised to give 98 € back, instead of the initial 100 € investment. This may seem crazy, but it shows the fear investors have. They prefer receiving less money, rather than risking their savings and getting higher interest rates.

As the economic situation in Spain is bad, investors have less confidence in the ability of the Spanish goverment to pay their 10 year bonds. Today, the interest rate of the 10 year Spanish bonds has risen to 6.67%. This means that every investor will receive 6.67 € per year for ten years. Their final profit will be 66.7 €. This means that for every 100 € the Spanish government receives for the investors, they will give almost 67 € back. This is unsustainable in the short term.

With these examples, we are ready to explain the risk premium concept: it´s the difference between the interest rate of the 10 year Spanish bond and the 10 year German bond. Today the 10 years Spanish bond interest rate has reached 6.67 % and the one of the German bond is 1.32%. The difference is equal to 5.39%. If we express this in basis points, we´ll have 539 basis points.

WHAT HAS BEEN THE EVOLUTION OF THE SPANISH RISK PREMIUM?

Here you have a graph where you can see the evolution of the Spanish risk premium in the last year. The graph shows the increasing distrust of the investors in Spain:

This graph also includes information about the figures the risk premium reached in the countries of the Eurozone that were bailed out just before their bailout. These figures are not reassuring. Greece, Portugal and Ireland were bailed out when their risk premium rose up to 500 basis points. The Spanish situation is a little better than the one in these countries, because the Spanish public debt is not so high (73.3% of the Gross Domestic Product for 2012, while Greece´s debt is 157.5%, the Portuguese debt is 124.3% , the Irish debt is 122% and the Italian debt is 120%), but if the country has to pay more interests to get money from the markets, the Spanish debt will increase dangerously.

Here you have another graph about today´s risk premium situation in the European countries that are going through bigger difficulties:

HOW DOES THE RISK PREMIUM AFFECT OUR ORDINARY LIFE?

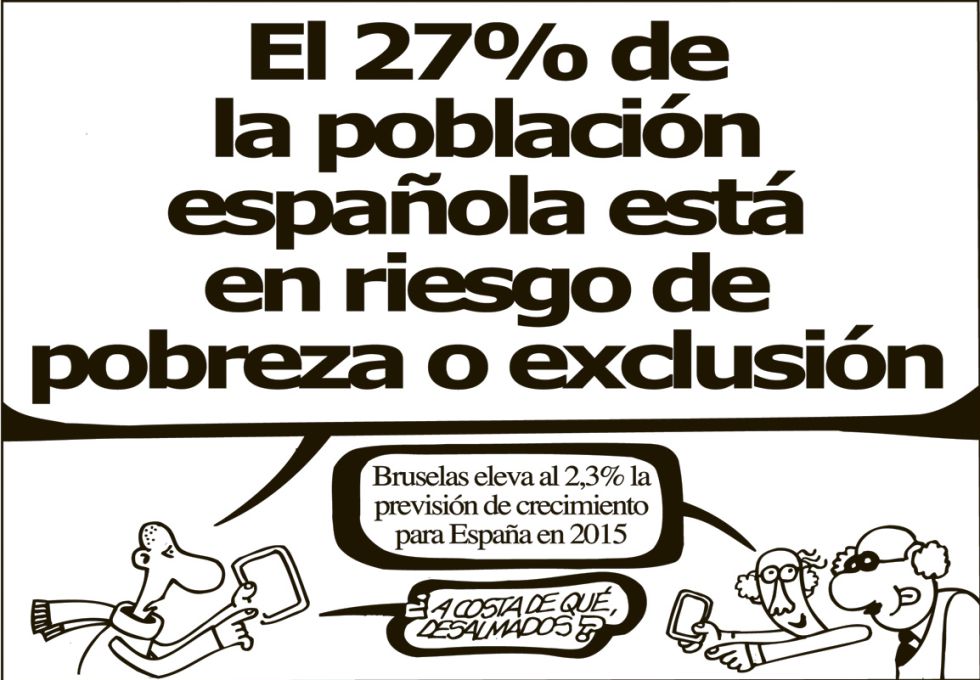

If the risk premium continues to climb, Spain will need European funds to pay the State debts. This would mean another bailout. If Spain is bailed out, the European Union will impose stronger rules to reduce the State debt and this will mean more and harder cuts and sacrifices for most of the population.

IS THERE ANY OTHER SOLUTION?

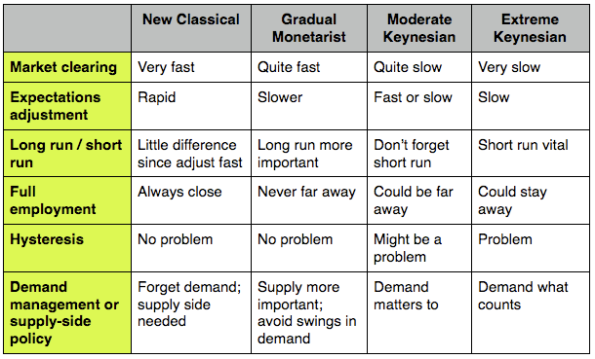

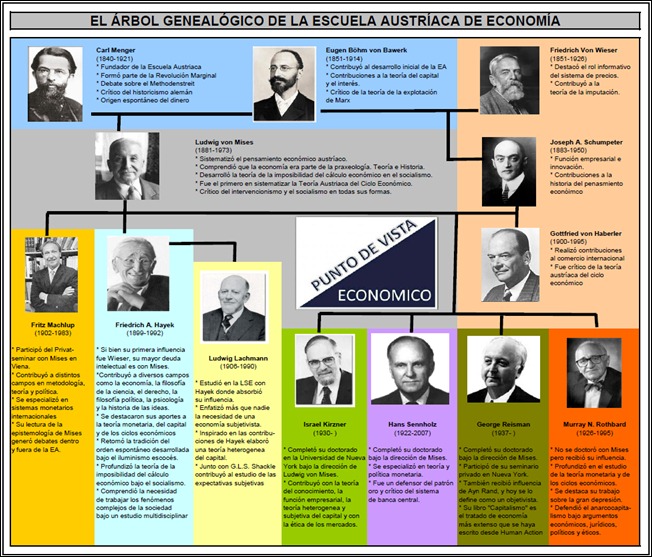

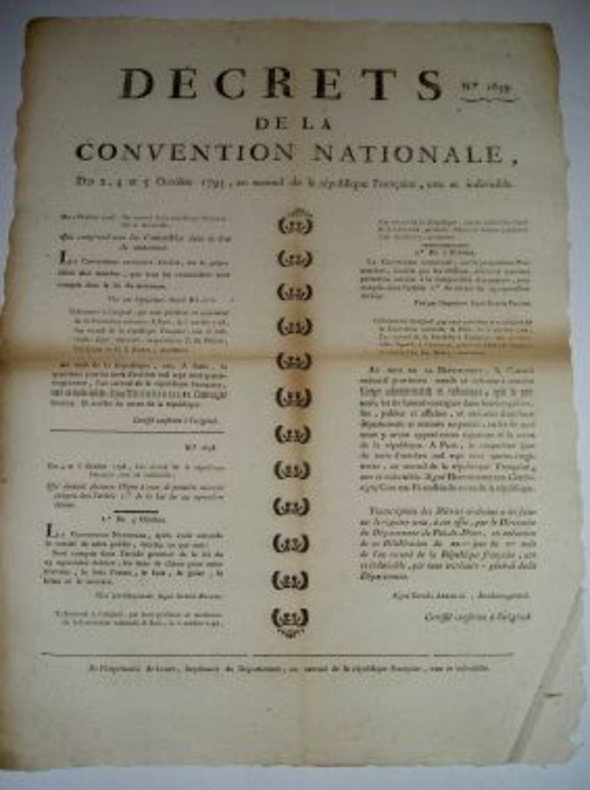

Of course there is. Remember what we´ve said today abouth Keynes´ ideas and the New Deal. The solution would be that the countries belonging to the Eurozone issue Eurobonds. The German reliability could be shared with the countries that are going through cash-flow problems, their risk premium would be lower and they could get money from the investors to finance their projects and start generating economic growth. Why aren´t the European leaders going this way? If there is a possible solution, why have they decided to let some countries fall down? As we know for previous experiences, this is a matter of choice. Choices determine the kind of people we are: supportive or selfish.