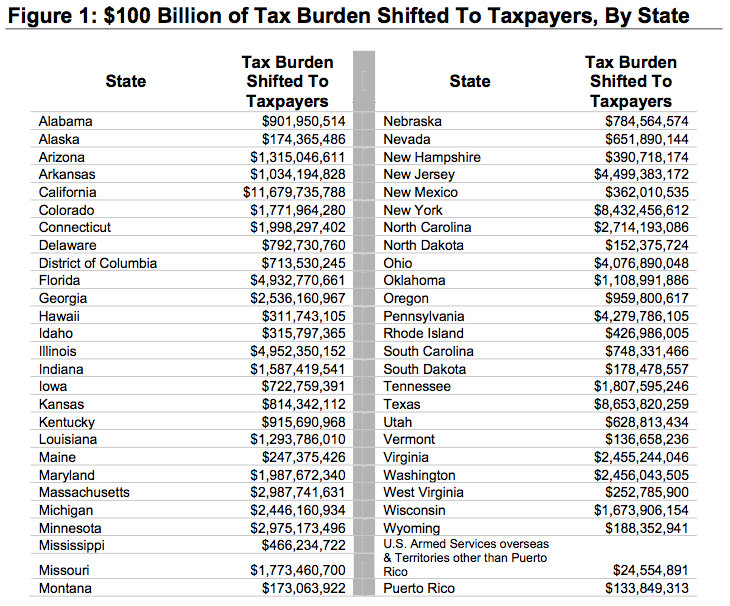

Spain isn’t the only country that has a problem with tax evasion and the use of tax havens. The United States also loses a lot of money! This article calculated that, “…in 2008 the United States lost up to $100 billion a year in tax revenue to offshore tax havens.”

http://www.huffingtonpost.com/2009/04/15/offshore-tax-havens-a-sta_n_186640.htmlThis is a table that shows the tax burden that American tax payers suffered because of people who put their money into tax havens. For example, in my home state of Connecticut $1,998,297,402 was not available in taxes in 2008 because dishonest people hid their money in tax havens.

Who pays the price? In the end, it's the tax payer who suffers because although they pay their taxes, they do not receive all the benefits that they would have received if everyone did the honest thing. Below you can look at the number for other states.

2 comments:

Really interesting, Kelly! Thanks for this link and the data. This situation gets on my nerves. Many "seroius" banks have hidden branches in tax havens and they put the money of their "best" clients there. BBVA was fined some years ago because of this practice. It´s a very dirty world. Nothing to do with paradise!

I think you´ve made a mistake. This is not a company, but a school blog. If you had read the posts carefully, you would have noticed that we are against tax havens.

Post a Comment